- 6th January 2018

- Posted by: web@taxes

- Category: whatsnew

No Comments

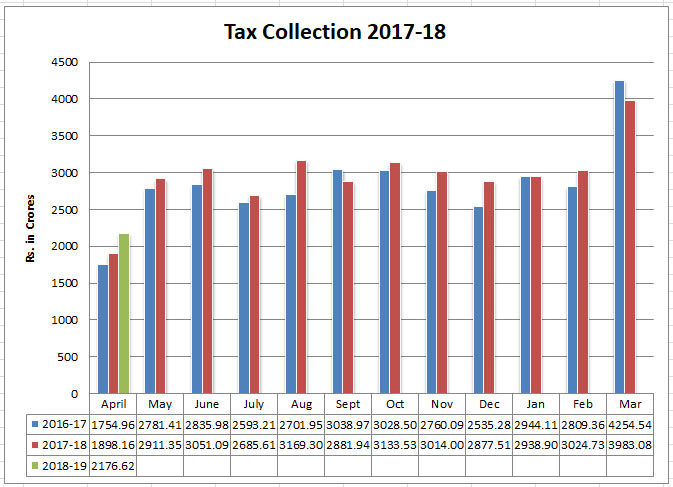

| Details of Collection and Budget Estimate for the year 2016-17 and 2017-18 | ||||||||||

| Sl no | Month | Tax head | Realised | Growth % (Year on year)) | ||||||

| 2016-17 | 2017-18 | |||||||||

| 1 | April | GST | 0 | 0 | ||||||

| VAT | 1564.81 | 1718.09 | ||||||||

| Non VAT | 190.15 | 180.07 | ||||||||

| Total | 1754.96 | 1898.16 | 8 | |||||||

| 2 | May | GST | 0 | 0 | ||||||

| VAT | 1442.35 | 1542.61 | ||||||||

| Non VAT | 1339.06 | 1368.74 | ||||||||

| Total | 2781.41 | 2911.35 | 5 | |||||||

| 3 | June | GST | 0 | 0 | ||||||

| VAT | 1429.23 | 1591.47 | ||||||||

| Non VAT | 1406.75 | 1459.62 | ||||||||

| Total | 2835.98 | 3051.09 | 8 | |||||||

| 4 | July | GST | 0 | 0 | ||||||

| VAT | 1397.03 | 1484.92 | ||||||||

| Non VAT | 1196.18 | 1200.69 | ||||||||

| Total | 2593.21 | 2685.61 | 4 | |||||||

| 5 | Aug | GST | 0 | 1168.21 | ||||||

| VAT | 1437.32 | 177.64 | ||||||||

| Non VAT | 1264.63 | 1823.45 | ||||||||

| Total | 2701.95 | 3169.3 | 17 | |||||||

| 6 | Sept | GST | 0 | 1570.51 | ||||||

| VAT | 1673.83 | 92.12 | ||||||||

| Non VAT | 1365.14 | 1219.31 | ||||||||

| Total | 3038.97 | 2881.94 | -5 | |||||||

| 7 | Octo | GST | 0 | 1563.12 | ||||||

| VAT | 1640.74 | 93.05 | ||||||||

| Non VAT | 1387.76 | 1477.36 | ||||||||

| Total | 3028.5 | 3133.53 | 3 | |||||||

| 8 | Nov | GST | 0 | 1411.66 | ||||||

| VAT | 1378.6 | 78.09 | ||||||||

| Non VAT | 1381.49 | 1524.25 | ||||||||

| Total | 2760.09 | 3014.00 | 9 | |||||||

| 9 | Dec | GST | 0 | 1396.46 | ||||||

| VAT | 1296.21 | 83.83 | ||||||||

| Non VAT | 1239.07 | 1397.22 | ||||||||

| Total | 2535.28 | 2877.51 | 13 | |||||||

| 10 | Jan | GST | 0 | 1519.9 | ||||||

| VAT | 1536.39 | 85.63 | ||||||||

| Non VAT | 1407.72 | 1333.37 | ||||||||

| Total | 2944.11 | 2938.9 | 0 | |||||||

| 11 | Feb | GST | 0 | 1430.73 | ||||||

| VAT | 1414.28 | 51.29 | ||||||||

| Non VAT | 1395.08 | 1542.71 | ||||||||

| Total | 2809.36 | 3024.73 | 8 | |||||||

| 11 | Mar | GST | 0 | 1407.03 | ||||||

| VAT | 1643.58 | 104.97 | ||||||||

| Non VAT | 2610.96 | 2471.08 | ||||||||

| Total | 4254.54 | 3983.08 | -6 | |||||||

| Grand Total | 34038.36 | 35569.20 | 4 | |||||||

| Sl no | Month | Tax head | Realised | Growth % (Year on year)) | ||||||

| 2017-18 | 2018-19 | |||||||||

| 1 | April | GST | 1503.74 | |||||||

| VAT | 1718.09 | 57.89 | ||||||||

| Non VAT | 180.07 | 614.99 | ||||||||

| Total | 1898.16 | 2176.62 | 15 | |||||||